We open the world of Scotch whisky maturation to you, the private investor

Good returns from whisky maturation have been achieved over many years, but historically only distillers and blenders could benefit.

Private investing had become possible but only through purchasing whole casks. Launched in 2015, WhiskyInvestDirect changed that, by allowing private investors to buy quality whiskies at wholesale prices typically at 30% of the cost of cask investment programs. Already some 5,000 users own enough to fill over 75,000 casks, that's the equivalent of 36 million bottles of maturing Scotch. Accounts range in size from £700 to £3,500,000.

Economies of scale mean your whisky will be stored — still in the barrel — at exceptionally low cost, in the original distiller's bonded warehouse. Its safe storage there is evidenced every month by our published audit.

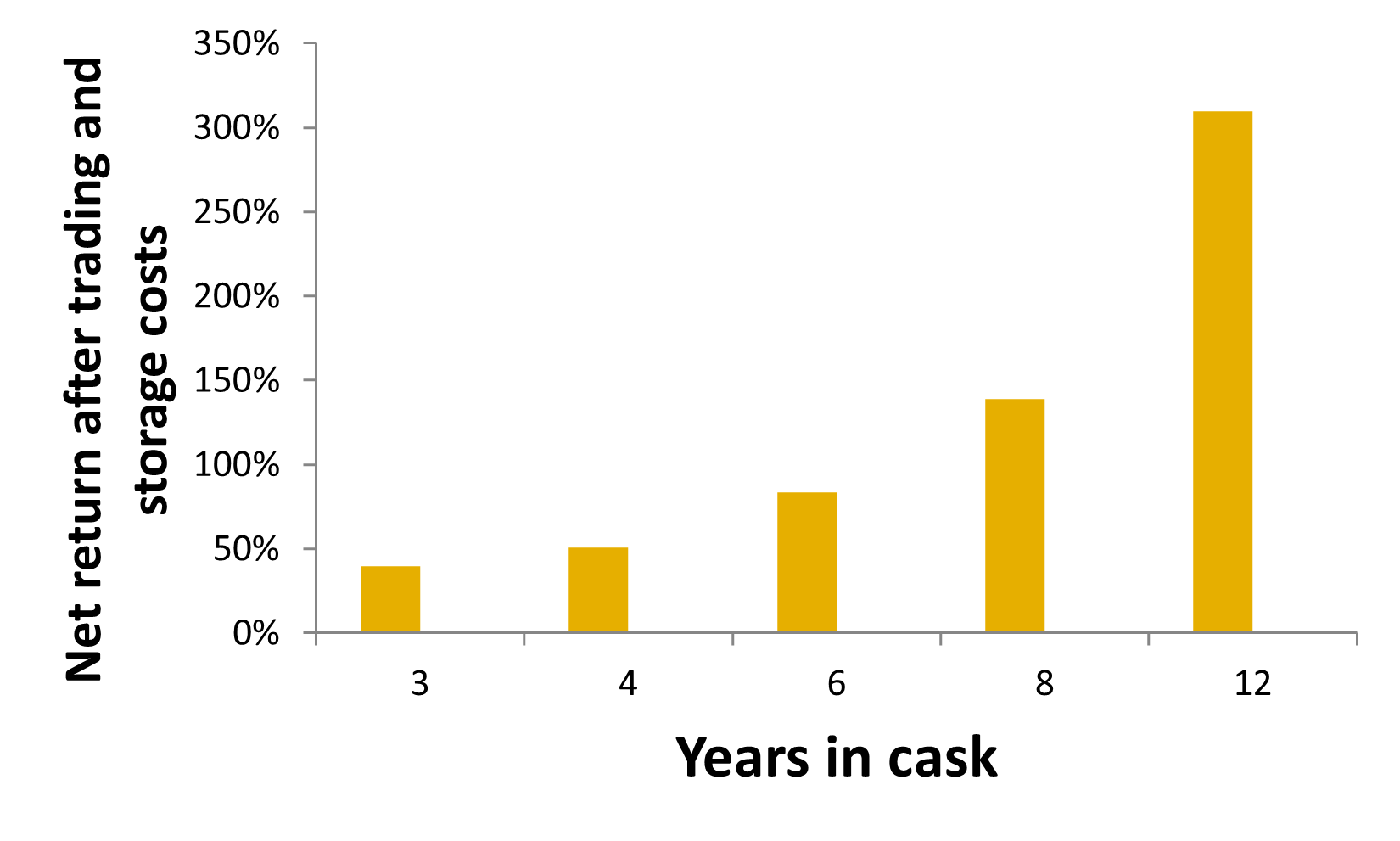

As it matures, and when you decide to sell, via our trading exchange, you'll receive a transparently competitive price from other users and industry bidders. At sale, mature whisky bought back by the trade has realised an average annualised return of over 15% — after all costs*.

Together we profit through tackling this industry's greatest problem — the large working capital requirement of financing maturing stock.

Which whiskies can I buy on WhiskyInvestDirect?

* Past performance is no guarantee of future performance. Capital is at risk.

Buy

Deposit money into your account. Buy.

Wait

Your whisky matures in the cask, improving with age.

Sell

Sell at anytime. Withdraw your cash.

Historical performance

The cash price for 8-year old Scotch whisky bought new, and sold each year of the decade 2015-2024 shows average historical returns of 11.7% per annum, net of all costs incurred on our platform.

This compares very favourably to deposit rates, but there are no guarantees and prices can be volatile

Industry broking data from the Scotch Whisky Industry Review. The data shown are net of trading commission, storage costs and evaporation.

Of course, we cannot guarantee you will make money.

Naturally there are risks. But there are many sensible reasons for investing in whisky maturation.

Why hasn't it been possible before?

Previously there have been two big problems which prevent private investors from participating in whisky maturation: complexity and scale. These combine to make prices of barrel whisky very much higher for smaller deals.

Easy access to our online exchange

- WhiskyInvestDirect aggregates the whisky stockholding demand of a crowd of private investors to become a major stockholding operator in the whisky market.

- We deploy substantial funds to buy young whisky on our own account direct from the distillers, and we arrange for its storage in bonded warehouses. See the whiskies you can buy on WhiskyInvestDirect.

- Via your WhiskyInvestDirect account you have access to these large stocks at industry wholesale prices, and ability to sell anytime.

Why choose WhiskyInvestDirect?

Whisky stays safely in the bonded warehouse

When you buy or sell only ownership of the whisky changes. It does not move. There is no shipment, and there are no delivery costs.Deal in any size

Trade in units from one Litre of Pure Alcohol (LPA) up to tens of thousands.No minimum holding period

There's no tie-in. Sell, and withdraw your money, at the time which suits you.Competitive prices

Cask investment prices are typically x3 higher than WhiskyInvestDirect prices.Notification of trade bids

We'll keep you informed when a blender is bidding for any stock line you own.Trade 24/7

Deal with other private investors, distillers, blenders or us - whoever offers you the best price - via our 24/7 live order board.Get paid straight away

When you sell, your funds settle instantaneously to your WhiskyInvestDirect account, ready to buy more whisky or to withdraw.Next-day withdrawals

Your money is returned by bank transfer the next business day.What does it cost?

Our fee structure is simple and transparent.

Commission to buy or sell: 1.75% by value.

Storage (including insurance): £0.218 per Litre of Pure Alcohol per year (£3 per month minimum).

Fees are billed to your account.

(For USD accounts, current rate: £1 = $)

Our credentials

WhiskyInvestDirect is part owned by Augmentum Fintech plc and is the platform of choice for Diageo, Pernod Ricard, CVH Spirits, Suntory and Whyte & Mackay.

FAQs

Which whiskies can I buy on WhiskyInvestDirect?

You can buy the following whiskies.

- Ardmore

- Ardnamurchan (non-peated)

- Ardnamurchan (peated)

- Auchentoshan

- Auchroisk

- Benrinnes

- Blair Athol

- Borders

- Bunnahabhain

- Cameronbridge

- Caol Ila

- Dailuaine

- Deanston

- Girvan

- Glenlossie

- Glen Elgin

- Glen Garioch

- Glen Moray

- Glen Spey

- Inchgower

- Invergordon

- Kirkcowan

- Kirkinner

- Ledaig

- Linkwood

- Mannochmore

- Nethermill

- North British

- Starlaw

- Strathenry

- Strathmill

- Tamdhu

- Teaninich

- Teithmill

- Tobermory

- Tomatin

- Tombae

- Tormore

- Tullibardine

We'll regularly add further whiskies to our order board as they become available.

How large is the Scotch whisky industry?

Scotch whisky is big business. Worth about £5 billion to the UK economy, Scotch whisky is responsible for 25% of UK food and drink exports.

How is Scotch whisky made?

Scotch whisky is made from cereals which are allowed to begin germination, a process which releases enzymes that turn grain starch into sugar. The germination is halted by heating, and yeast is added to ferment the sugary mixture. The fermentation result - basically beer - is distilled to produce a clear-coloured, sharp distillate which is not suitable for drinking and which contains several hundred complex organic compounds. Water is then added back, and the mixture is stored for maturation in naturally permeable, second-hand, oak barrels.

The barrels, which will previously have stored bourbon, sherry or possibly port, offer a richly complex semi-permeable membrane through which gases can pass. There the many different organic chemicals interact both with the distilled spirit, and with each other, during this maturation process.

In ways which are not fully understood the chemistry of the distillate changes subtly as it reacts with the second-hand wood, and with the cold, damp, Scottish air which slowly crosses the membrane.

What's the difference between single malt whisky and grain whisky?

Single malt whisky is made in a traditional batch process using a copper pot still at a single distillery. Single malt is the premium, traditional style of whisky, but the artisanal manner of its production is not easily scaled. When bottled as single malt it accounts for 8% by volume and 18% by value of Scotch whisky production.

Single grain whisky is made continuously via a modern column still, on industrial scale. The output is purer alcohol, but with much less flavour and character than a single malt. The single most important fact about whisky is that the fate of very nearly all single grain whisky is to be blended with one or more single malts to produce a much better tasting derivative type called blended Scotch whisky.

Single grain accounts for 60-85% of the volume of blended whisky, which accounts for 92% of Scotch sales by volume, and 82% by value.

How big is the world market for Scotch whisky?

The world market for Scotch is currently about 100 million cases, 93% of which is exported from the UK. This is equivalent to about 35 bottles leaving Scotland every second of the year.

It is relatively evenly distributed across major markets.

Scotch has a 4% share of the global spirit beverages market by weight, and about 12% by value. It sells as a high status premium drink primarily to affluent middle-aged men.

The fortunes of Scotch are closely correlated to the world economy. Growing global GDP tends to encourage Scotch demand. Scotch consumption tends to falter when economies contract.

Will the extra inventory WhiskyInvestDirect causes to be produced cause a glut, and depress prices?

This is a theoretical possibility - but the scale of the industry makes it very unlikely.

The industry is comfortable with 8-9 years' worth of sales undergoing maturation. Forecasting at least eight years ahead is difficult so the market has always been cyclical.

WhiskyInvestDirect's plan, over 10 years, is to own and store a small percentage of the aggregate stock - equivalent to between 1% and 3%. This is in line with the sales growth projected by many industry analysts.

What quality is the whisky?

All the spirit/whisky is good quality single malt and grain produced by reputable distillers.

How is the whisky stored?

The whisky is stored in oak barrels, in bonded warehouses in Scotland. The warehouses are run by highly reputed whisky producers with whom WhiskyInvestDirect has entered into agreements for storage.

The particular bonded warehouse location of every barrel is specified, and evidenced on the monthly Audit, published on the WhiskyInvestDirect site.

Stockholders often redistribute barrels from the same batches to multiple sites, in order to reduce single site exposure for each individual whisky.

These warehouses operate under Duty suspension, and HMRC exercises strict control over them.

How much whisky is in a cask?

Cask contents vary according to barrel type

Our most common 'hogshead' barrel contains approximately 250 liquid litres. The spirit is filled into the cask at 63% alcohol, so there are roughly 157 Litres of Pure Alcohol (LPA) in each cask. Both the whisky and the water evaporate - together at just under 2% per year. Because the alcohol evaporates a little quicker than the water the strength slightly reduces during maturation.

Commonly used bourbon barrels hold around 120 LPA and larger sherry butts hold over 300 LPA.

Do I have to buy an entire cask?

No. Our unit of measure is a Litre of Pure Alcohol, or LPA. You can buy as little as one LPA, but with our minimum storage charge of £3 per month such small purchases are not economical.

Which whisky is the best to buy?

We expect each whisky to mature well. While we can't predict future demand, we know that all the whiskies we buy are important components in leading Scotch whisky brands.

Where does the stock of whisky come from?

We buy directly from a variety of well-known and widely respected Scottish distillers.

On the order board - where you trade - you will see each different whisky identified by name. Many of them are very well known.

How do I know when my whisky is mature?

A whisky can be considered 'mature' as young as three years old, or it might carry on maturing for 20 years. It depends on many factors, not least of which is the marketplace, and how much brand premium a brand owner can expect to earn from bottling that particular age.

The best way we can tell that a whisky is approaching maturity is that a brand owner decides to buy some of it. When that happens we keep you informed.

What happens when the whisky has matured?

We all share the objective of getting mature spirit profitably bottled and shipped to the consumer. That is the job of the brand builders and trade customers, and we keep them informed regarding the availability of maturing stock on WhiskyInvestDirect.

Before WhiskyInvestDirect, brand owners who had sold all their 10 year old production had restricted opportunities for buying more whisky. This is what we change.

In the future, the more marketable your particular holdings, the more attention you will get from trade buyers who need mature blending stock for their successful brands.

Sometimes the trade will simply post bids for a particular stock line on our order board. They can ask us to notify owners, to draw attention to the bid, which means you will not have to keep a close day-to-day watch on bidding.

They can also make Bulk Trade Bids. These offer a way for trade buyers to acquire a lot of whisky from multiple owners under the same commercial terms. We always notify our customers when there is a Bulk Trade Bid and of course bidders have to make their bid attractive in order to encourage holders to sell. Often these bids will offer you a premium from the prevailing price.

Once you sell, the buyers will withdraw the whisky from the warehouse for blending and/or bottling. Then the whisky is usually shipped to consumer markets rapidly. They take care of the associated formalities and charges.

As a user you do have a bottling right, which you can certainly use if you think your whisky would profit you better in your own bottles. But don't forget there are issues with warehouse licensing, shipping and tax. WhiskyInvestDirect is not suitable for small scale bottling runs because the minimum fees are set for industrial quantities, and are significant.

What about evaporation?

Barrel whisky evaporates at just under 2% per annum, which is known as the Angels' share. Evaporation is part of the maturation process.

Wholesale whisky is traded as Litres of Pure Alcohol (LPA) on an Original Fillings Basis (OFB). In combination they refer to the amount of spirit which went into the barrel at the outset (filling).

When you come to sell your whisky it doesn't matter how much has evaporated. You sell LPA on the OFB. It is up to the buyer to make an approximate calculation of how much actual spirit will be in the barrel by anticipating the total quantity shared out between 'the angels'.

Can I visit the distillery?

Approximately 50 of the 100 Scotch distilleries are open to visitors. Some of the others are happy to arrange visits by appointment.

I can't see the whisky I am interested in.

There are over 100 single malt distilleries in Scotland. WhiskyInvestDirect deals in significant volume in top quality malts and grains and regrettably there will always be some fine whiskies which are unavailable.

Which whisky is the best to buy?

In value terms it's difficult to differentiate between the available whiskies. We stock some famous brands, and they can trade at a premium over the others. But this is not necessarily a good indicator of ultimate financial returns, and as with stocks and shares it is never obvious which will be the winners. Again, just as most investors select a variety of stocks and shares, most of our users choose a sensible and conservative variety of whiskies.

The following are some issues you should bear in mind:

- Single malt whisky is generally considered more valuable than single grain whisky.

- Whisky appreciates in the barrel. So older whisky is generally considered more valuable than younger whisky.

- Different barrels mature whiskies with different results. Sherry and port barrels are harder to source and impart particular flavours, so whisky matured in these barrels are generally considered more valuable than whisky matured in more common bourbon barrels.

- First fill barrels usually mature better than refill barrels, so they are usually considered the more valuable.

- In percentage terms, because storage is charged according to physical volume, the carrying cost of cheaper whiskies is higher in percentage terms than the carrying cost of more expensive ones.

- The historical data suggest that after allowing for storage costs and evaporation the financial returns in the decade from 2006 to 2015 on typical blending single grain whisky was slightly superior to the return on typical blending single malt.

- Over the last decade (to 2015) sales of single malt have grown faster than sales of blended Scotch whisky.

What's better, grain or malt?

Grain (~75%) and malt (~25%) are the key ingredients in blended Scotch whisky, which represents about 90% of the market, with the other 10% being single malt.

Consequently grain whisky is produced in higher volumes, and from a small number of very large industrial distilleries. It is widely considered inferior to malt and relatively few people enjoy drinking it unblended as single grain whisky.

Malt is more varied and more characterful - and also more expensive to produce. Large numbers of people enjoy single malt whiskies, which do on occasion become very highly sought after, and can therefore provide a high potential upside to the investor.

Both grain and malt require barrels for maturation, and of course both cost the same to store. So the running cost of owning cheaper grain spirit works out as a higher percentage of your investment.

All of these factors suggest that single malt is the better product.

However in considering value you must also consider price, and single grain usually costs materially less than a similarly aged single malt.

So in spite of the superiority of single malt over single grain, over the last 10 years, because of its lower buying price, single grain has usually provided a higher overall return.

Can I see a breakdown of performance by distillery?

We have no historic data on the performance by distillery. We will of course track this data as we go forward.

How are prices for buying and selling determined?

The WhiskyInvestDirect order board acts as a stock exchange for whisky.

It is directly accessible to all - to you, other users, the industry professionals, and WhiskyInvestDirect itself. On it you will see competing bids and offers from anyone ready to trade their whisky.

These bids and offers produce, at any time, a highest (best) bid, and a cheapest (best) offer, which will usually be very close to each other. The midpoint between them is considered the current price of a whisky.

WhiskyInvestDirect accepts a special responsibility when it comes to its offer prices for new whisky stock. We undertake that stock which we bought wholesale within the previous 2 months will be offered within 2% of the price we paid for it.

Who is WhiskyInvestDirect's regulator?

WhiskyInvestDirect operates under English law. Financial services regulations that apply to more complex investments are not applicable here, as our service involves your direct ownership of physical assets.

Maturing whisky in a cask is a physical, tangible commodity, not a credit risk or a paper-based right traded as a security. As such, the trading, custody, and delivery of whisky are not subject to the provisions of the UK's Financial Services and Markets Act 2000. Consequently, WhiskyInvestDirect is not regulated by the Financial Conduct Authority (FCA), nor is such regulation required. The company operates under English law.

This sort of purchase, and the custody of your property, is regulated by a number of laws which are generally more intuitively and widely understood than is financial services regulation. The relevant legislation includes the Sale of Goods Act 1994, Fraud Act 2006, the Theft Act 1968, and the Money Laundering and Transfer of Funds (Information) (Amendment) (EU Exit) Regulations (2019) etc.

If you believe WhiskyInvestDirect had committed a crime, it would not be your responsibility to prosecute the case. For example, if you suspect theft, you would report it to the authorities, such as the London Metropolitan Police, the UK Crown Prosecution Service and the Criminal Court system, whose duty it would be to run the investigation and any prosecution. Separately, if you alleged a breach of our Terms and Conditions - which govern our business relationship - you could seek recourse under civil law. However, pursuing a civil case would typically involve costs for you.

While WhiskyInvestDirect is not regulated by the FCA, it voluntarily adopts many of the responsibilities typically required by the financial services regulator for businesses managing other, less tangible forms of private wealth. These responsibilities include:

- the segregation of customer property to be held independent of a company's finances;

- the keeping of accurate records and the availability of those records for inspection;

- the declaration of a conflict of interest when acting as principal in a transaction;

- accountability to written Terms of Business;

- adherence to a specified complaints procedure;

- maintenance of a compensation fund.

WhiskyInvestDirect adheres strictly to these best practices, striving to maintain a transparent environment where its compliance with these principles is both evident and demonstrable.

What would happen if WhiskyInvestDirect failed?

Your whisky is safe from WhiskyInvestDirect's insolvency - a liquidator cannot claim it as an asset of the business.

With many investments (e.g. a deposit account, or a bond) you transfer your property to a business and allow yourself to be treated as a creditor. If that business were to fail this would entitle you, as a creditor, only to a proportionate share of the gross assets of that business, which would in due course be distributed to you by the liquidator.

But through WhiskyInvestDirect your property is held in safekeeping. This means you make no transfer, and your whisky does not become owned by WhiskyInvestDirect. You are not a creditor, you are the whisky's owner.

Consequently the liquidator cannot consider your whisky as the property of the company, and must return it to you in full before any payout to creditors. This is the huge advantage of being an owner of property and not a creditor of a business. You cannot lose your stock through insolvency, only through its physical theft or destruction, and these risks are insured.

How can I be sure the whisky is there?

Your whisky is stored in HMRC-registered bonded warehouses, managed by the Scotch whisky producers we buy from, all of whom are members of the Scotch Whisky Association.

The whisky producers provide a cask list, which lists all the casks and the spirit maturing in each. We publish the cask lists on our web site.

Every month we also publish online our register of owners and their holdings. (We hide identities by listing holdings against your public nicknames, not usernames.) You can check for yourself that the total on the register matches the total on the cask list.

Do I get a certificate as proof of ownership of my whisky?

It is very important that we do not provide you with a certificate! Why not?

A formal certificate changes the legal status of what you own from a physical asset, to a security evidenced by a certificate which purports to be backed by whisky. Suddenly the law has to consider what would happen if there were more certificates in issue than there was whisky backing them.

Title to WhiskyInvestDirect client whisky derives from the register which modern technology (the internet) allows us to put in the public domain.

You will receive a monthly statement which reflects the register. Also you can view the register whenever you want online. WhiskyInvestDirect is structured for you to own whisky, not a security.

Is the whisky insured?

Yes, all the whisky is insured. The cost of the insurance is included in the storage charge.

Can the whisky spoil or go off?

Rigorous quality controls are done before the whisky is filled into cask. Once the whisky is in cask it is rare for it to spoil and any spirit quality issues are almost certainly due to a defective cask which can be isolated before blending or bottling. WhiskyInvestDirect customers are protected from any quality issues by our standard commercial agreement with suppliers.

How do you guarantee the quality of the whisky?

The whisky you buy is sourced directly from selected leading distillers who have their own high quality standards. We also sample the whiskies we buy to ensure they meet our expectation.

The following information is presented as guidance for UK investors.

Will I have to pay UK Capital Gains Tax?

In the UK most people have an annual CGT exemption. In 2023/24 it is applied on the first £6,000 of gains across all their investments, down from £12,300 in the previous tax year. This will be further reduced to £3,000 for tax year 2024/25 and subsequent tax years. If profits on WhiskyInvestDirect are deemed capital gains, then ordinarily the amount of the annual exemption would apply, and profits above the annual exemption are ordinarily taxed at 20%.

There is a possibility that the tax treatment of investing in whisky in bond will attract less tax. There are arguments concerning wasting chattels.

A wasting chattel is an asset with a predictable life of less than 50 years. This applies to the vast majority of whisky casks, but since some casks can usefully mature whisky beyond 50 years it is not a certainty that whisky in bond can be treated as a wasting chattel. We are still awaiting firm clarification from HMRC.

Will I have to pay UK VAT/Sales Tax?

No. Maturing whisky stored 'in bond' is exceptionally rare in being a physical product in which you can invest without paying VAT.

Personal tax issues vary, and WhiskyInvestDirect accepts no responsibility or liability in respect of the information presented in answer to any matters of tax. You should make further investigations yourself, and consult appropriately qualified people if necessary.

I'm under 18 years old. Can I invest through WhiskyInvestDirect?

WhiskyInvestDirect does not accept users who are under the age of 18. Also, you should be of legal age to purchase alcohol in your jurisdiction.

Can I use more than one bank account to fund my WhiskyInvestDirect account?

Linking a single bank account with your WhiskyInvestDirect account gives you a very high level of security.

In exceptional circumstances, you can link a new bank account to your WhiskyInvestDirect account. When doing so, we will of course need to go through a strict security process to ensure the safety of your account.

Which currencies can I use on WhiskyInvestDirect?

You can operate your WhiskyInvestDirect account in British Pounds or US Dollars. When you open your account you choose which of these currencies you wish your account to be denominated in. You may send deposits in other currencies, in which case our bank will convert the funds, at their standard conversion rates, once they reach our client account. Or you can convert the funds before sending your payment. You can ask your bank to do this for you, but you may be able to obtain a better conversion rate by using third-party currency-conversion specialists.

Is there a minimum length of time I have to keep the whisky?

You can sell your whisky at any time. However, you are unlikely to recoup your trading costs if you use WhiskyInvestDirect for very short-term investments.

Generally you should try to avoid exiting within the first few months.

Can I reserve my own cask?

No. It is not possible to reserve an individual cask.

Can I take delivery of my whisky? Can I taste it?

It is possible to have your whisky bottled and delivered to you but the complications and costs of setting up a bottling run are significant.

You should probably think of yourself as an 'in-bond' wholesaler. Under these circumstances you will neither take possession nor sample the whisky.

Your whisky will be stored safely along with the whisky belonging to other WhiskyInvestDirect users. It is possible to have your whisky bottled and delivered to you but the costs are not insignificant. More information on taking delivery is available in our help pages. We do not offer a sampling service.

Can I hold my whisky in a UK SIPP?

No. It is not possible to hold your whisky in a SIPP.

Open an account

Try out buying and selling with a free sample.

Transfer funds

Make a bank transfer to your account.

Buy whisky

Choose which distilleries on our live order board.

Validate your account

Upload photo ID and bank statement.

Contact us

Phone

UK and International: +44 (0)20 8600 0135

Opening hours

9am to 5:30pm (UK), Monday to Friday

Address

WhiskyInvestDirect LtdUnit 5

Berghem Mews

London W14 0HN

United Kingdom

Registered in England and Wales: 09068458