'Scotch' in all but Name

If your brand is sufficiently powerful, it seems you can bend the famously strict rules that govern Scotch whisky, even if your low-strength, flavoured offerings are 'officially' something else. Ian Fraser investigates the blends dipping a toe in the growing pool of 'spirit drinks' …

The flavoured spirits segment is growing so fast, it is becoming increasingly difficult for Scotch whisky companies to ignore. The segment expanded by 46% between 2018 and 2023, according to IWSR data, with sales of flavoured "whisky" soaring by 67% over the same period.

In a comprehensive article on flavoured whisk(e)y published last November, VinePair said it is now omnipresent in the US market, where it has become "a major part of modern drinks culture". And in a recent overview of the UK spirits market, the researchers Gourmet Pro said flavoured spirits are rapidly gaining ground – with "UK consumers increasingly experimenting with flavours like spiced, tropical, and dessert-inspired profiles." Gourmet Pro also pointed out that the vodka and rum categories are ahead of Scotch, implying traditionalists have little choice other than to hold their noses and go with the flow.

Former Spirits Business editor Amy Hopkins believes the underperformance of early Scotch entrants into the flavoured arena – which included Dewar's Highlander Honey, launched by Bacardi in March 2013 and then quietly dropped - effectively left the coast clear for American and Canadian whisk(e)ys. However, since then, she says Scotch brands have been "tentatively stepping back into the ring," bolstered by the fact consumers are becoming more attuned to the concept of flavoured Scotch, while becoming less averse to the notion of a 'spirit drink'. Now she believes the industry cannot afford to ignore the allure of flavours.

The latest Scotch whisky to introduce a flavoured variant is Ballantine's. Pernod Ricard-owned Chivas Brothers launched Ballantine's Sweet Blend on 24 February 2025 exclusively in the Polish market – where consumers, especially younger ones, have a penchant for sweeter alcoholic beverages. According to Chivas, Ballantine's Sweet "masterfully intertwines the classic essence of Scotch whisky with sweet, indulgent notes of caramel and vanilla, resulting in a delightfully versatile and inviting pour" and its "enticing flavour profile appeals not only to non-whisky drinkers, but also to whisky aficionados".

Given the drink is 30% abv, it is clearly not Scotch whisky – although some of the language used in the press release coupled, of course, with the use of the Ballantine's name and branding suggest Pernod would not be too unhappy if some consumers thought it was in fact a Scotch.

Overall, Chivas Brothers is ahead of the curve where flavoured 'Scotch' is concerned. The company launched Ballantine's Brasil (35% abv – lime flavoured), initially in the Czech Republic and the Netherlands, back in 2013. At the time, its global brand director Peter Moore said: "There's a huge opportunity for spirit drinks made with whisky… It looks like it isn't going to be a short-term fad", prompting New York Magazine to publish a semi-humorous article, headlined: "Flavoured Scotch Whiskey Is the Beginning of the End."

Undeterred, Pernod went on to launch at least five other flavoured and low-alcohol products under the Ballatine's banner, including Passion (35% abv, tropical fruit flavoured) in 2018; Light (20% abv) in 2021; Wild (30%, cherry-flavoured) in 2022; Sunshine (30% pineapple-flavoured) in 2024; and now, of course, Sweet. Many of these were trialled in markets such as Poland and Spain before being rolled out elsewhere. The company said Ballantine's Light, launched in tandem with a low-alcohol Beefeater Light 'gin', was targeting consumers seeking so-called "mindful drinking" – suggesting there is also a responsible-drinking angle to the marketing push.

Diageo's dalliances with flavour have been a little more faltering. It introduced J&B Urban Honey in Spain in 2014, and a hoppy-flavoured spirit drink named Boxing Hares in Germany and Austria in 2015. It then waited seven years before launching Haig Club Mediterranean Orange, with help from brand ambassador David Beckham. That was followed by Buchanan's Pineapple, a 35% abv spirit drink specifically targeted at America's 66 million-strong Hispanic community, in 2023. It is easy to get confused by the nomenclature – one article covering the Buchanan's Pineapple launch was headlined "Buchanan's Newest Blended Scotch Brings The Flavor Of Pineapple" (Whiskey Wash,).

Not to be outdone, William Grant & Sons launched Grant's Summer Orange in Poland and France in 2022, adding Grant's Tropical Fiesta last October. Again, even though the words 'spirit drink' are prominently displayed on Grant's web pages, there has been some confusion about what these actually are, with South African media mischaracterising them as "whiskies".

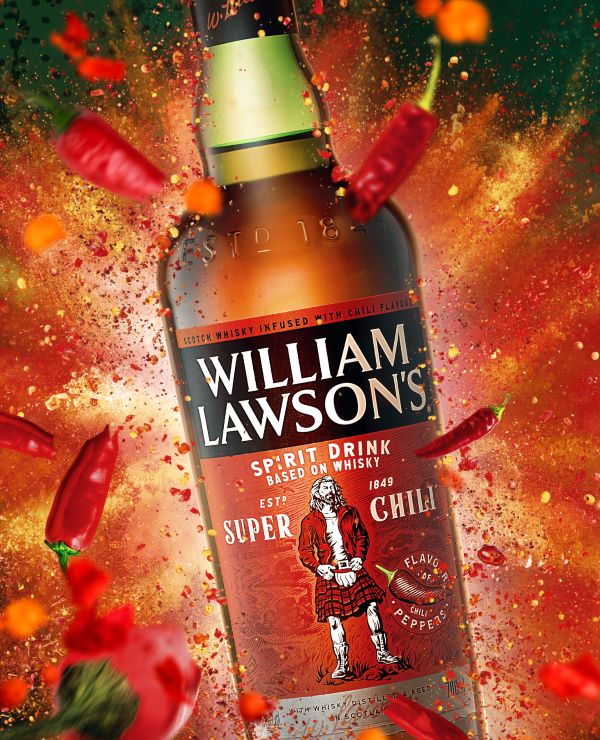

Back in 2017 Bacardi co-launched William Lawson's Super Spiced spirit drink with Russian bottler Beluga Group. But in Belgium, the product appears to be causing some confusion, with online retailer Wijnhuis Bollaert describing the product as "Whiskey William Lawson's super spiced vanilla…a delicious whisky with a twist". A spokesperson for the Scotch Whisky Association (SWA) told WhiskyInvestDirect: "If there is a concern that a particular product is being confused with Scotch whisky, we would, of course, investigate that."

Overall, North American whiskeys are still way ahead when it comes to flavours. Dominant brands include Skrewball, a peanut-butter flavoured whiskey, acquired by Pernod Ricard in 2023, and Fireball, a cinnamon-flavoured Canadian whisky owned by New Orleans-based Sazerac Company. Diageo has seen some success with five flavoured variants of its Canadian whisky Crown Royal, including salted caramel and blackberry, in the US market since 2014. Meanwhile Jack Daniel's launched Tennessee Honey in 2011, cinnamon-flavoured Fire in 2015, and an apple variant in 2019.

Bump Williams Consulting's Dave Williams does not believe distillers are "dumbing down" in entering flavour territory. Instead, he told VinePair it's really a battle to retain relevance and indeed survive. "Brands like Jack Daniel's and Jim Beam, core whiskeys and bourbons, those brands are down year-over-year. Crown Royal whisky is down. Their family is up, because of their flavours."

Back in Scotland, the SWA has to balance the desire to innovate with the need to protect the rules around Scotch which, in the words of its spokesperson: "forbid the addition of any sweetening or flavourings, and this tight definition has been an important factor in building and maintaining Scotch whisky's reputation with consumers worldwide."

"Innovation is also important for any industry, and there is no bar to producing new products based on Scotch whisky which are sold under brand names associated with it. However, the labelling and marketing of such products must not confuse consumers by suggesting the product is Scotch whisky when it is not. Spirits based on whisky with added flavouring have been on sale for many years and they are appropriately marketed as a 'spirit drink', which is the legally required sales description, and consumers will be informed on the label as to their constituents, for example, that it contains Scotch whisky and other ingredients."

Ian Fraser is a financial journalist, a former business editor of Sunday Times Scotland, and author of Shredded: Inside RBS The Bank That Broke Britain.