Premiumisation - Slowed but Unbowed

Given all the economic headwinds out there, can the industry's favourite buzzword really survive? Having weighed up the arguments for and against, Ian Fraser brings this three-part series to a close…

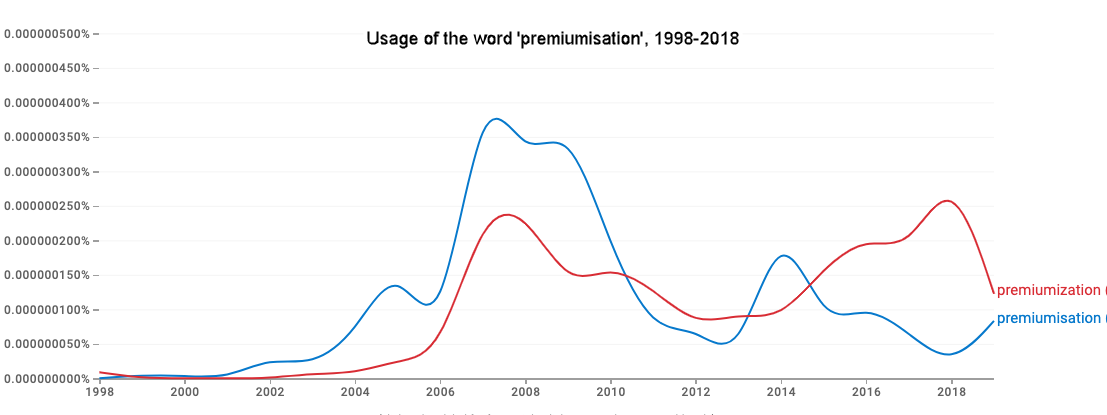

"It is a somewhat barbaric word", admitted Alexandre Ricard, CEO of Pernod Ricard – owners of Chivas Bros – in an interview with La Revue Du Vin de France eight years ago. He was referring to "premiumisation", a word which he claims was pioneered by a senior marketeer at the firm's Paris headquarters back in 2002.

Irrespective of the uncivilised connotations, the word caught on not just at Pernod Ricard but across the wider industry. Despite a slight dip in usage after the 2008 financial crisis when many customers were feeling the pinch, it has become a key part of the strategy of almost every serious player in Scotch.

Source: Google Books Ngram Viewer

At its crudest level, it's shorthand for persuading customers to pay more for similar or even identical products, often through the use of fancier packaging or added 'bells and whistles'. It often involves launching new, more expensive variants or limited editions of mass-market or mass-luxury brands as part of an attempt to lift them out of the pricing troposphere of "premium" and into the stratosphere of "super-premium".

It can also mean rejigging a portfolio, by selling off cheaper, mass market brands in order to focus on a smaller group of brands which are considered to have greater potential for premiumisation – something Edrington Group, owner of The Famous Grouse, did with aplomb in the 2000s and 2010s.

Such strategies have the advantage of enabling distillers to generate higher profits from lower volumes (even once advertising and marketing costs are taken into account); they're also good for the environment, since less whisky needs to be distilled and transported, with fewer glass bottles and less cardboard needing to be bought and shipped.

Then there is the sotto voce 'benefit' of educating consumers about the merits of 'drinking less, but better'. In doing so, premiumisation allows the industry to sidestep claims that it's contributing to problem-drinking or alcohol dependence and thus keep the health lobby at bay.

The big question, though, is, given changing demographics, inflation and the cost-of-living crisis and higher interest rates, can the premiumisation bandwagon continue? There are certainly views on both sides – see 'Here to stay' and 'Press pause'.

Spiros Malandrakis, spirits analyst at Euromonitor, has warned of "the fallacy of infinite premiumisation", saying drinks firms' over-reliance on the "Baby Boomer" generation has blinded them to the fact that Millennials are much more cash-strapped and economically precarious, and therefore unable to blindly trade up.

In a recent edition of Commercial Spirits Intelligence, Martin Purvis summarised the economic pressures that are hurting consumers before adding: "When people are struggling to afford food, discretionary spending on spirits will be under pressure…. High-value spirits are more discretionary for households when food bills are rising."

The latest HMRC figures for the first six months on 2023, do show a 3.6% fall in the value of Scotch exports to £2.57 billion, but given that volumes fell 20%, it suggests premiumisation is, at the very least, hanging in there. Or, to paraphrase Mark Twain - news of its death is probably exaggerated.

Laurence Whyatt, drinks analyst at Barclays says: "Globally, many have predicted the end of premiumisation over time, and I suspect that Spiros' prediction is also premature. As long as we get increasing wealth per capita (and, actually, increasing inequality), we're likely to continue to see premiumisation." He points out that the size of a country's premium spirits market increases exponentially as its GDP-per-capita rises.

Whyatt adds: "I wouldn't be overly concerned about the recent Latin America weakness – that looks more like a normalisation in that market rather than a persistent decline. I do see some demographic weakness, but that is mainly coming from China."

IWSR data from China shows a shift in the alcohol-drinking population, with fewer 18−24 year olds engaging with alcoholic beverages, which may be linked to the 20% unemployment among Chinese graduates, while the country's continuing property crash is also having knock-on effects.

For Graeme Littlejohn, the Scotch Whisky Association's director of strategy and communications: "Nothing is infinite but the trends are clear – premiumisation is here to stay. Consumers at home and abroad are switching to a more responsible approach to alcohol, drinking fewer units of higher-quality products, and Scotch whisky is central to that."

"It's still too early to give a full assessment of 2023 export performance," he adds, "but one thing is clear; the industry's exporting baseline has increased since 2019 and the start of the pandemic. £4.9bn of value exports in 2019 was recorded at the time, and it is striking that hitting over £6bn for two years in a row just four years later would seem, to some, disappointing. It's clear that the demand for Scotch whisky is there, and the fact that value is growing at a faster rate than volume is evidence of premiumisation in action."

At the very top of the market, there's little sign that wealthy consumers' thirst for older and rarer bottles of Scotch is satiated. Gordon & MacPhail recently announced pretax profits had surged by 67% to £17.4 million on the back of its successful 'Gordon & MacPhail Generations' - a Glenlivet laid down in 1940, of which bottles sell for £110,000.

At Sotheby's 'Distillers One of One' charity auction in October, a Brora 50-year-old sold for £400,000 and a Bowmore 1962 fetched £562,500. A month later, the auctioneer knocked down a bottle of The Macallan 'Adami' 1926 for £2.1m – a new world record for Scotch. Meanwhile, even standard bottles of Macallan 40-year-old now retail for £29,000- £30,000.

So even though premiumisation may be decelerating, or may have gone into reverse in certain markets, there seems little doubt it is an enduring trend, at least for the foreseeable future. IWSR's head of research Emily Neill, says "in the longer term, the premiumisation trend looks to be structural in many parts of the beverage alcohol market – and it is likely to withstand shorter-term economic and geopolitical turbulence, as it has done in the past."

Ian Fraser is a financial journalist, a former business editor of Sunday Times Scotland, and author of Shredded: Inside RBS The Bank That Broke Britain.