Pernod’s Half-Term Report

Despite suffering in the US, Pernod's global Scotch business was only marginally down in the company's latest results and somewhat better than Diageo's performance in the category. As Ian Fraser reports, much of the credit lies with its leading blend – Ballantine's …

The fact that Pernod Ricard was obliged to bring forward its first-half results by a week, as a result of French stock-exchange rules which require Paris-listed companies to notify investors of material changes to their sales guidance as soon as they become aware of them, could be a sign of things of come.

The on-off threat of US tariffs from erratic and increasingly unpredictable US president Donald Trump, isn't the only impediment that's thwarting sales expectations and making forecasting difficult for global spirits groups. They are also facing more intractable phenomena including that of premiumisation becoming harder to maintain in a weaker macroeconomic climate, the rise of 'chauvinistic' drinking habits in key export markets, as in the shift to home-grown single malts, as well as the rapid growth of teetotalism among 'Gen Z' drinkers.

Pernod Ricard – which owns Ballantine's, Chivas Regal, Royal Salute, 100 Pipers, Passport, Glenlivet and Aberlour through its Glasgow-based Chivas Brothers arm – divulged that, as a result geopolitical uncertainties, it is now expecting "low single-digit fall in organic sales" in its current financial year (up to 30 June 2025). It had previously predicted a modest return to sales growth in the same period. Pernod also trimmed its longer-term guidance, predicting that its organic net sales will grow by 3-6% in 2027-29, down from previous estimate of 4-7%.

Edward Mundy, a drinks analyst at Jefferies, praised the company for giving the market a "more realistic guide" and believes the results represented "a clearing event" for Pernod. A couple of days earlier, its staunch rival Diageo withdrew its medium-term sales goals altogether, following pressure from investors who believed they were unfeasible.

In a separate statement issued the day after Pernod's first-half results, Chivas Brothers said its organic net sales fell by 2% in the second half of 2024, when compared to the same period the previous year. That represented a slower pace of decline than its parent company whose organic net sales fell by 4% overall in the six months.

Chivas Brothers said it experienced a slow first quarter (July-September 2024), followed by a gradual recovery in the second quarter (October-December). Overall, its performance was better than Diageo whose organic net sales in Scotch were down 5% over the same period.

Chivas Brothers blamed what it called a "modest dip" in Scotch sales on the "complex market dynamics seen across the wider Scotch category, alongside ongoing global economic headwinds". It added that the performance of strategic brands such as Ballantine's, Chivas Regal, Glenlivet and Royal Salute varied across major 'drive' markets, with "softening partially mitigated by the business' broad and balanced global footprint". In an attempt to put a positive spin on things, the company stressed that its Scotch whisky sales were up 5% vis-à-vis the equivalent period in 2019.

Chivas' chairman and CEO Jean-Etienne Gourgues, said the first-half performance "reflected the complexity of the global Scotch market, along with the agility and resilience of our organisation. While we remain realistic about short-term challenges, we're taking a dynamic approach to investments in our brands and in our business to help navigate through these headwinds while preserving our long-term ambition."

One of its worst performing markets was the US, where its Scotch sales slumped by 10%. Direct comparisons are difficult, but that compares to a 13% fall in sales of Diageo's dominant Scotch brand – Johnnie Walker – in North America (which also includes Canada) over the same period. China was a major disappointment for both industry giants. Chivas Brothers' first-half sales in the People's Republic plummeted by 19%. While comparable figures are not available, Diageo did say: "[overall group] Greater China net sales declined 4%, primarily driven by Scotch." Chivas Brothers fared better in selected emerging markets, including Turkey – where Scotch sales were up 56% – Brazil (up 8%) and India (up 1%). That was largely fuelled by the success of premium blends - Chivas Regal and Ballantine's.

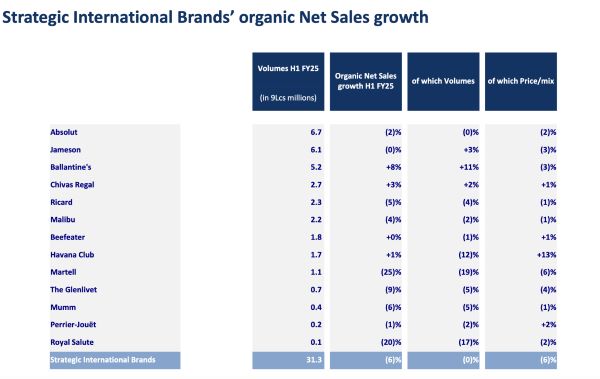

"Ballantine's put in a stand out performance… everything else is under more pressure," was the assessment of analyst Martin Purvis of Commercial Spirits Intelligence. With the brand's global sales up 8%, he predicted that Ballantine's would break the 10 million case barrier in the year to June 2025 in his report on the results. Having been 6.5m cases in the year to June 2017, that would be "a remarkable performance for an established blended Scotch whisky," he claimed.

Sales of Chivas Regal grew by a more pedestrian 3%, supported by the introduction of extensions such as Chivas Regal Extra Smoky Cask, which the company said performed well in its launch market of Turkey. Such trajectories were ahead of those of Johnnie Walker, whose global organic net sales fell by 5%.

Sales of The Glenlivet – the Speyside single malt Pernod Ricard acquired from Seagram in 2001 – fell by 9%. Its sales peaked at 1.6m cases in 2022-23, but Purvis predicts this will fall to around 1.2m in the current full-year. Royal Salute – also bought as part of the Seagram transaction – was being touted as a star performer as recently last year – but it experienced a 20% slump in sales (to 100,000 cases) in the first-half. Chivas Brothers blamed this on "tightened consumer spending across key Asian markets, with the exception of Taiwan, where appetite for Royal Salute's signature blends persists." By contrast, global net sales of Diageo's single malts were down 20% in the company's first half.

In an accompanying press statement Pernod stressed that despite trade tensions, market turmoil and other challenges, the company will continue to invest in its brands, promising to deliver "continuing efficiency initiatives that optimize operations and simplify the organisational structure [which are] expected to deliver circa €1bn in efficiencies from FY26 to FY29".

In his conclusion on the current health of the Scotch industry and the performance of its two biggest players, Martin Purvis sounded reasonably upbeat. "The volume fall has been arrested and, hopefully, sales will pick up as we pass through 2025 and into 2026," he told WhiskyInvestDirect about Chivas Brothers, adding: "My feeling from the two sets of results, and the recent export data, is that things are not as gloomy as I thought."

Ian Fraser is a financial journalist, a former business editor of Sunday Times Scotland, and author of Shredded: Inside RBS The Bank That Broke Britain.