Scotch exports down 10% as growth markets stall out

Murmurs of weak sales have abounded for a while now, and today's export data from HMRC proves that Scotch whisky exports fell off in 2023. But how bad is it really, asks Ben Challen for WhiskyInvestDirect…

The figures for the first half of the year hinted at it, Diageo's half-year results upheld it, and the latest export figures released today by HMRC confirmed it – 2023 failed to live up to the dizzying precedent that 2022 set for Scotch whisky. Exports were down 9.6% in value, at £5.6 billion, and sales by volume dropped 19%.

Today the Office for National Statistics published its latest batch of export figures to complete the set for 2023. The writing had been on the wall for a while, but with the full data in front of us, we sat down to take a look at the year from the taxman's perspective and see where the wins and losses came.

It's hard to deny there were more losses than wins in 2023. When we wrote last year's article looking at the figures for 2022, there was a sense then that they were almost too good to be true. Now it seems that might just have been the case – 2023 told a story of overfilled warehouses, and stock sitting in backrooms waiting to be sold.

Many of the top brands have found that their pull-through – the rate at which bottles actually get sold, leading to more exports to fill the gap – has been much lower than expected in several key markets.

The actual activity on the ground may not be that different from usual, but the numbers achieved in 2022 may have led many to bet on growth that never materialised. Sales reps incentivised to meet performance targets found that when the time came for their buyers to place the next order, those buyers still had full inventories.

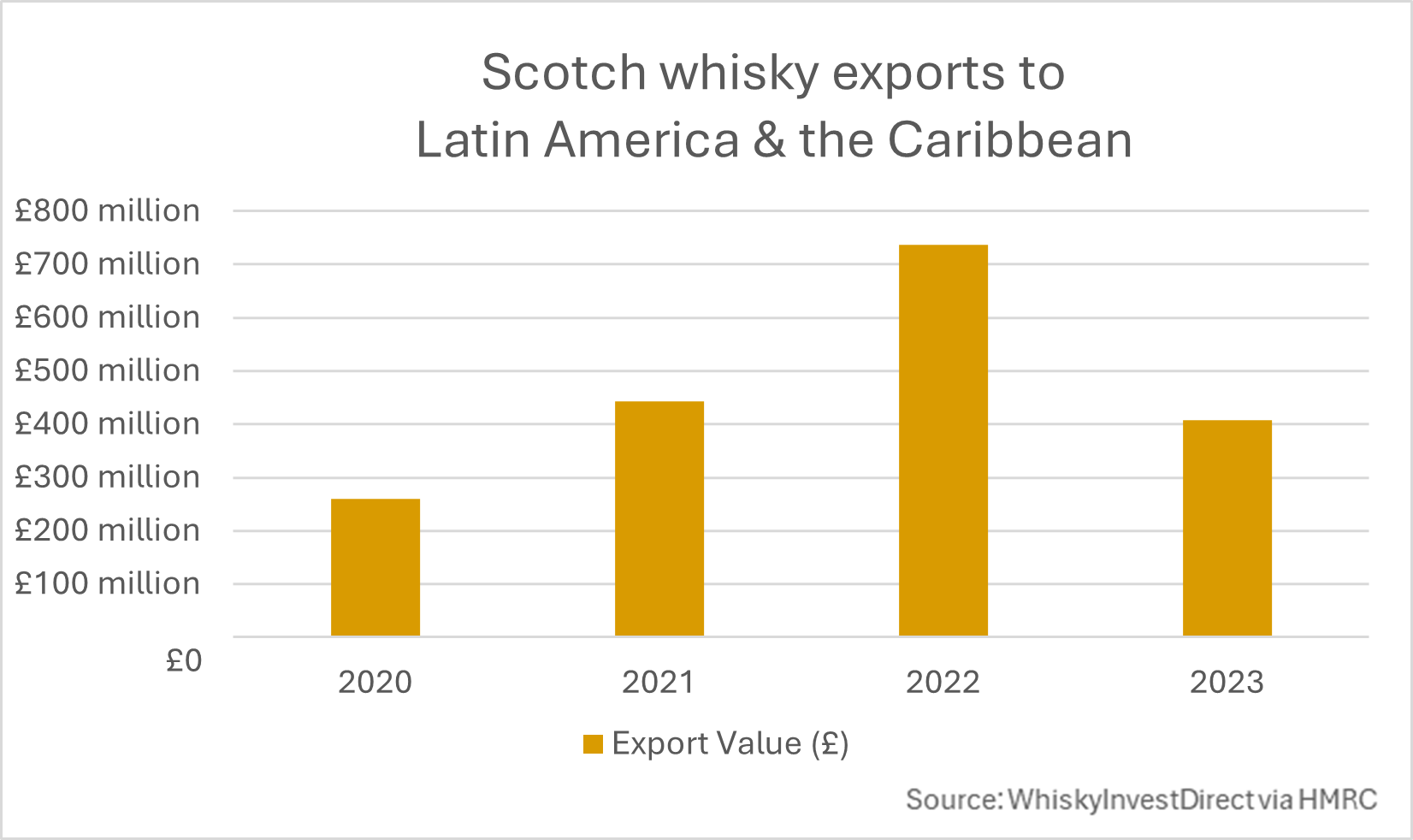

A key factor in the slowdown is Latin America (LAC), which has gained a reputation for being quite a volatile region. A key market for Diageo, among others, LAC has been seen as a promising area for growth, and a lot of marketing investment had gone into it over the last few years. 2022 reaped the rewards, with exports to the region up 66% in value.

But if you live by the sword, you die by it also, and LAC's volatility came back full force in 2023 with exports plummeting 45% back to just over £400 million. This region alone accounted for 55% of the total global drop in value in the year, despite only making up 7% of global sales.

Further north, the US continued to suffer, down 7%. The States is still comfortably Scotch whisky's biggest market, but brands have repeatedly struggled to win the attention of drinkers being captivated by Irish whiskey and tequila. All of the loss came in the blended whisky category, and marketing departments will continue to rack their brains for ways to stop the drift.

India also had a rough year, down 22% in value and 24% in volume, although it should be noted that exports to the country were still 50% higher than in 2021. Indian was a clear example of the general problem, that too much liquid was shipped in the previous year, and warehouses have been running their stocks down. Single malt sales continued to grow, and suppliers will keep their fingers crossed that the tantalising trade talks finally bear some fruit.

Looking at the monthly figures across the globe, much of the drop in value came in Q4, with November and December particularly weak. On the heels of Diageo's profit warning in early November, it seems as though many leading players switched their focus to selling out what stock they had in many key markets, rather than sending more in.

Steps have clearly been taken to right the ship, but even those closest to the action may not truly know the scale of the overstocking in place. The rest of us will have to keep a close eye on export figures in early 2024 to see whether things level out, or whether Scotch whisky is in for another downswing after a whirlwind few years.

In the words of WhiskyInvestDirect co-founder and industry veteran Rupert Patrick, "These numbers come as no surprise. The extraordinary growth, to over £6bn in 2022, looked unusual at the time. And now we know that it was not the real picture.

"The industry seems to make the same mistake rather too often, but canny insiders in the Scotch trade always know to look at the medium to long term trend and not what happens one year to the next."

It's worth keeping in mind that if you cover up the figures from 2022, this year was still more than £1 billion up versus 2021, and 14% up on the next best year in history. The biggest company in the Scotch whisky world has been hit hard in one of its key growth markets, and that will always show through in the numbers. But for everyone else, the overall picture has much to be hopeful about.

While boardrooms around the world may be straining in search of endless growth, it's okay to recognise that while things could be better, they are definitely not bad. 2023's slump is not serious enough to threaten Scotch whisky's global status, and it may just be the spark that drives brands to seek more sustainable growth, rather than simply pumping up the numbers with unneeded exports.

Commercial Director at WhiskyInvestDirect, Ben Challen is at his happiest when surrounded by whisky and statistics, sifting through the data to find out what makes his favourite industry tick.