Scotch whisky exports down 4%, but showing signs of recovery

Export figures released today by HMRC confirm what the financial results of Diageo and others have suggested - 2024 was a slow year for Scotch whisky. However, a closer look at the numbers shows some reasons to be optimistic, as Ben Challen investigates for WhiskyInvestDirect...

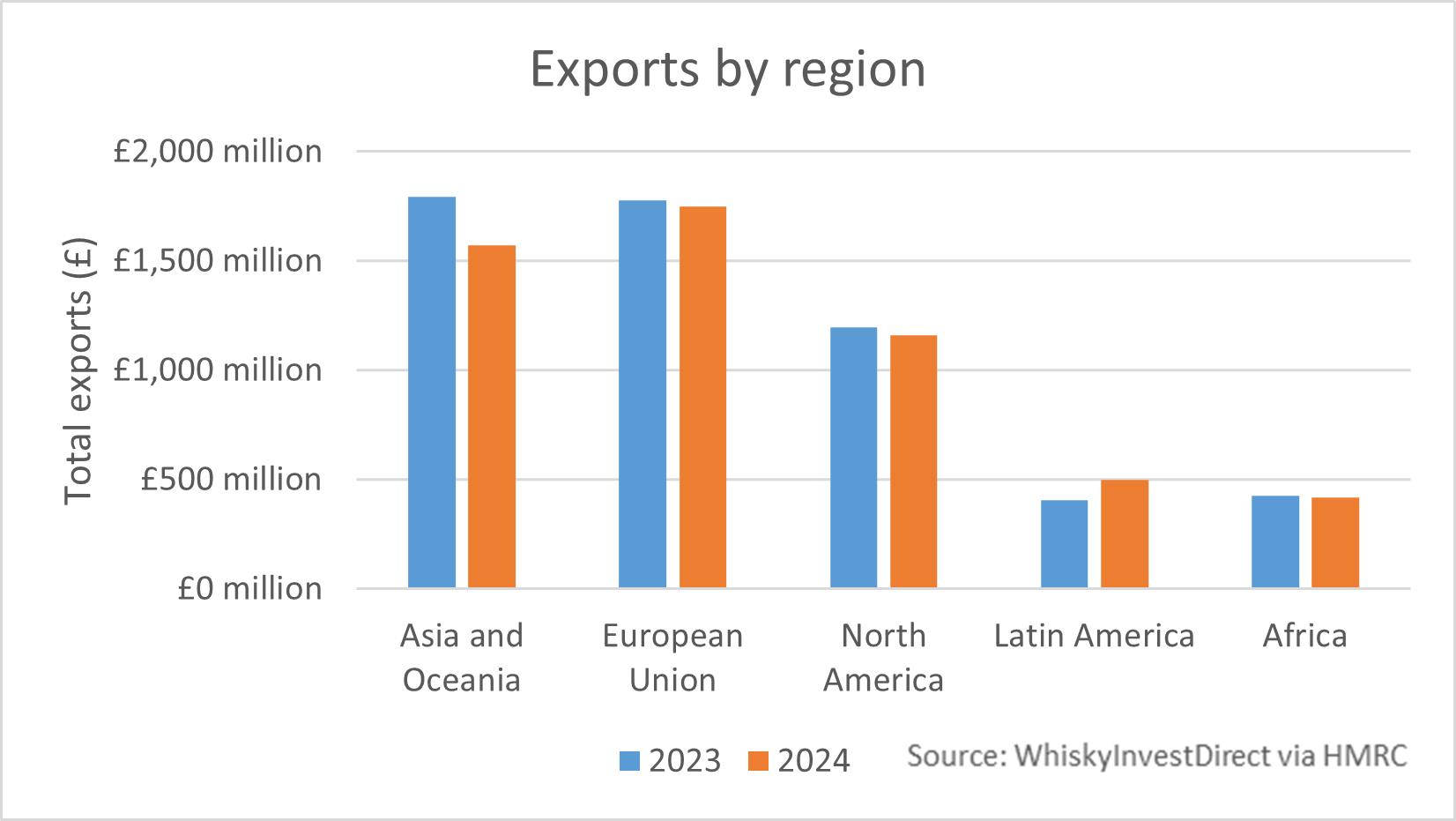

Scotch whisky exports for 2024 reached £5.4 billion, down 3.7% versus the previous year. After a poor start to 2024, exports strengthened towards the end of the year to give investors a bit more confidence.

Today’s UK export figures released by HMRC show that, despite being down 8% by value through the first 8 months of the year, global exports rallied to show growth of 3% in the last 4 months. While caution is still evident amongst key players (Diageo speaking of “green shoots” of recovery in their half-year figures), it is clear at least that the problems of excess stocks that clouded the start of the year have been worked through.

Any who feared that a downturn in sales might lead to a glut of whisky can take encouragement though – despite the drop in value terms, exports by volume were up by 3.9% year on year. Scotch whisky is getting back to basics, focusing on its value offerings in key markets and putting the mantra of premiumization on hold.

The average price per bottle of whisky exported dropped 5% to £18.63, and we also saw a shift in the amount of bulk whisky shipped – 14% more than in 2023, mainly to its usual markets in India, France, and Japan, but also a 46% increase in shipments to the US, who usually ship almost all their Scotch over in bottles.

Asia in particular was an extreme example of the shift in pricing, with sales by value down 13% year on year, but actually up 6% in volume. China was down 32% in value and just 2% in volume, and the big players in the Scotch whisky industry seem to have been successful in making sure that even if customers trade down, they don’t trade out.

Latin America reversed its 2023 slide, with exports back up by 22% in value. LatAm was emblematic of the struggles the industry has faced with supply chain management and overstocked warehouses, so seeing sales returning to normality will provide a sigh of relieve to those with interests in the region.

Lots of eyes will be on Scotch whisky’s biggest single market in the USA, with fresh memories of tariffs on single malt from Donald Trump’s last reign as president. For now though, the rhetoric seems more muted, and Scotch whisky may even benefit if rivals in Mexican tequila and Canadian whisky end up getting hit with the 25% tariffs being discussed. Sales by value were steady, down 0.7% in 2024, and you can be certain that key players are waiting with bated breath, ready to spring into action when the picture becomes more clear.

All in all, the outlook is not exactly bright, but it is certainly a light at the end of a brief tunnel. Export volumes increasing is a sign that while economic hardships might have hit the high end, the fundamental demand for Scotch whisky remains strong.

In the words of WhiskyInvestDirect co-founder and industry veteran Rupert Patrick, "The data for 2024 shows, once again, that the global market for Scotch is resilient and that the category is underpinned by steady demand at the grass roots level. Those companies that continue to provide good quality Scotch at fair prices will come through this downturn fitter and stronger."

2024 will remain the 2nd best year in history for Scotch whisky exports by volume, and the 3rd best by value. Things have levelled out after the whiplash of COVID, and while investors might have hoped to follow 2022’s success all the way to the moon, those with experience of the industry will have their eyes on the long term, and will be happy to see we are entering the next phase of the cycle.

Commercial Director at WhiskyInvestDirect, Ben Challen is at his happiest when surrounded by whisky and statistics, sifting through the data to find out what makes his favourite industry tick.