Trebles All Round - Diageo's Year-End Results

Diageo has posted impressive year-end results with Scotch sales booming, led by its great mother-brand - Johnnie Walker. But with global uncertainty, and inflation letting rip, can the company keep it up? wonders Tom Bruce-Gardyne for WhiskyInvestDirect…

"IT'S been a record year for Johnnie Walker," declared Ivan Menezes, Diageo's CEO, as he unveiled the firm's full-results (FY22) last week. "We will cross £2 billion in sales for the first time ever, and cross 21 million cases."

That equates to a 34% jump in value and a 24% hike in volume on the previous twelve months.

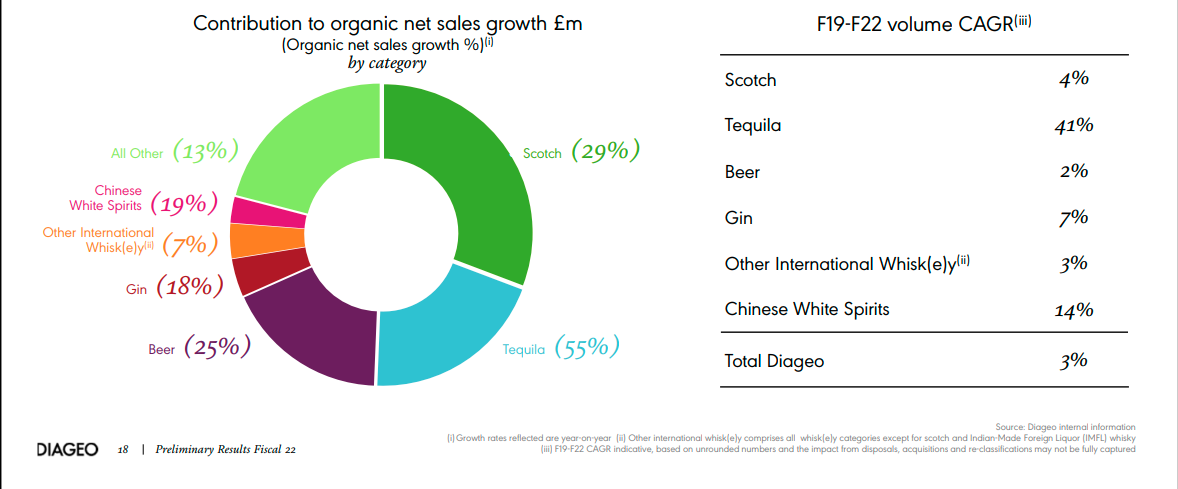

It has been a pretty good year for Scotch whisky all round at Diageo Towers which now happily resides in Central London after its grim years in exile out by the A40. The category, which accounts for a quarter of the firm's turnover, was up 29% in net sales – a performance eclipsed only by Tequila which grew 55%.

When announcing Diageo's results two year ago, Menezes spoke of "wanting to win with our global giant" and "to make Johnnie Walker the most desired, enjoyed and talked about whisky in the world."

But the omens were not good back then, and caught in the eye of the Covid storm, the Striding Man was stumbling badly, down 22% in net sales while the value of the company's Scotch business shrunk 17% in FY20.

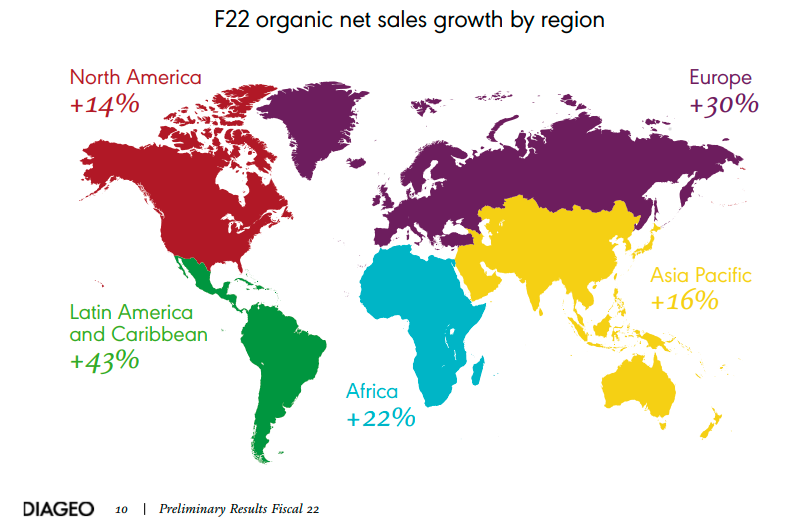

Today, as the world's on-trade bounces back and with travel retail in partial recovery, Menezes' faith in the brand is well proven. Plenty of its less famous Scotch siblings also did well, with Buchanan up 39% in value and Old Parr up 59%. This is in large part thanks to a resurgent Latin America where total net sales grew 43%, making it the firm's best-performing region at present.

The 63 year-old CEO credited his 28,000 colleagues and their brand-building prowess, along with that deep-rooted trend, beloved of international booze barons – 'premiumisation'. Looking back, there is plenty of evidence to support this, not least from the Striding Man himself.

Red Label, which retails for around £15 in the UK saw its global net sales increase by 20% in FY22, despite losing ground in the US. Black Label, at £30, grew 40%, while Blue Label which sells for upwards of £150, jumped 60%. So, as Menezes says: "You can see the trade-up within the Johnnie Walker trademark."

But, what with inflation pushing 10% here and in America where there's talk of an impending recession, can that relentless drive up-market really be sustained? Or, to put it another way, can Diageo continue to pass on its soaring production costs and raise margins, as it has been doing, while its consumers find their pockets severely squeezed?

"The first thing I'd say is this trend of people drinking better has been in place for a long time," Menezes told me. "When you go back through economic cycles to the global financial crisis, you saw a few quarters where that trend reversed a little bit, and then it came roaring back."

Other factors he mentioned are spirits' growing share of total beverage alcohol – now 40%, where it was 30% a decade ago, and the fact "the category we're in is an affordable luxury."

"In America, in the households where they consume spirits, they spend US$330 a year – that's a dollar a day on spirits."

He claims the market for premium spirits "is not the high net worth – the top 1-5%. In the United States, a huge amount of what we call 'super-premium-plus' is happening at household incomes of around US$80,000. This is not an everyday consumption habit. You buy, maybe one or two bottles of Johnnie Walker Blue a year for a special occasion."

In other words, the infrequency of purchase appears to cushion these high-end brands from the sort of price pressures faced by other goods.

But to make it work, you need tip-top marketing to keep the brand front of mind for that rare moment of indulgence. The fact that Diageo inflated its global A&P budget to a record £2.7bn in FY22 from its pre-pandemic high of £2bn in 2019 is no doubt part of its success.

Diageo has also been offloading a few low-grade brands and acquiring more luxurious ones. It hasn't bought anything in Scotch where competition laws probably wouldn't allow anything significant, but it is selling its Windsor blend for £124m to a private equity group in South Korea where Scotch shipments have collapsed by three quarters in a decade.

Meanwhile, lurking in the background, are those punitive Indian tariffs. "It's very hard to call," said Menezes when asked if he predicts a major tariff cut this year. "The FTA agreements are happening and Scotch whisky is on the table, but India has big asks and the UK has big asks, and we'll have to wait for a new prime minister. But, it's more encouraging than it's ever been."

If and when it happens, he insisted that Diageo is ready. "For a product like Scotch whisky there's nothing like more demand. We'll manage the allocations around the world." So, no danger you'll run dry? "All we'll do is make it more expensive," Menezes replied with a grin.

Award-winning drinks columnist and author Tom Bruce-Gardyne began his career in the wine trade, managing exports for a major Sicilian producer. Now freelance for 20 years, Tom has been a weekly columnist for The Herald and his books include The Scotch Whisky Book and most recently Scotch Whisky Treasures.

You can read more comment and analysis on the Scotch whisky industry by clicking on Whisky News.