Scotch Whisky's Hangover Year

Following the great export binge of 2022 when Scotch was surfing the Covid super-cycle, there was bound to be a 'morning after' of sorts. But in crunching through the latest HMRC shipment figures, Ian Fraser finds a mixed picture …

The Scotch Whisky Association was keen to put a positive spin on a disappointing set of export figures for the industry last week. In a release, the SWA made frequent comparisons between the occasionally dire 2023 export numbers and those from the pre-Covid year of 2019.

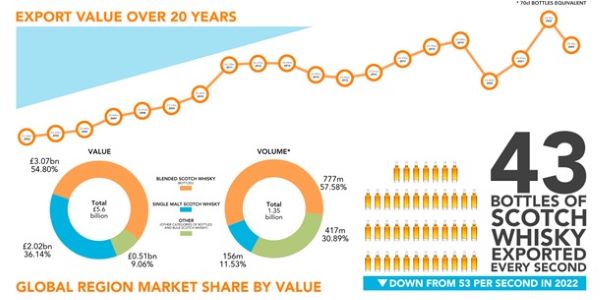

Sentences such as "exports of Scotch Whisky have risen by 14% in value compared to 2019, with a 3% increase in volume," definitely helped put the most recent export figures in a better light than drawing parallels with 2022, an exceptional year for the industry when total exports broke through the £6bn barrier.

But however brave one's face, it is difficult to be positive when the figures show that overall exports of Scotch whisky, fell 9.6% by value last year – down from £6.2 billion in 2022 to £5.6 billion – and 19% by volume.

Image credit - SWA

Contributing to the fall, were markets like Australia where value slumped by 36% and volume by 27%. The country imported £52 million's worth of bottled blends last year, down from £84m in 2022, while malts fared somewhat better, dropping from £46m to £37m. While, on the other side of the world, Canada tumbled 23% in value to £106.5m and by 27.5% in volume.

A much bigger market – considered Scotch Whisky's great white hope, is India, but after its record £281.7m of Scotch shipped in 2022, it slipped back to £218.4m last year, while volumes fell 24% to the equivalent of 13.8m cases. 'Equivalent' because there is still a lot of bulk Scotch shipped that disappears into Indian whiskies. However, single-malt sales in India continue to grow steadily, with value exports trebling from £10.1m in 2020 to £31m today.

Brazil was even worse hit. Scotch exports to South America's largest economy crashed by 41.9%, down from £152.7m in 2023 to £88.7m. By volume, exports were down an astonishing 54% (they fell from 7.7m cases in 2022 to 3.5m last year). The only types of whisky not showing massive falls in Brazil were blended malts and single malts, but these have relatively small sales of below £5m.

At a half-year results presentation on 30 January, Diageo CEO Debra Crew blamed the collapse on the "Covid-19 super-cycle", and channel-stuffing and inventory pile-up. She believes Diageo "really underestimated" the stocks of Scotch in the Brazilian supply chain, much of which would have been exported there during the boom year of 2022.

Exports to the US, still the biggest market for Scotch by value, fell by 7.1% by value, sliding to £978m in 2023 from £1.05bn in 2022, and they were down 7.5% by volume, falling from 10.6m cases in 2022 to 9.9m. Value exports of bottled blends, by far the biggest category in the US market, fell 12.5% to £525.7m. As elsewhere, single malts performed better, with £394m worth exported to the US in 2023, down by 1.3% on the £399m exported in 2022. Malts now account for 40.3% of value exports to the US, but only 19% of the volume of exports.

Geopolitics are having an impact. Latvia was, for many years, the favoured gateway for sales of Scotch into Russia and other ex-Soviet states. However, exports to Latvia have collapsed, with most large distillers following western government guidance and boycotting Russia since Vladimir Putin's 24 February 2022 invasion of Ukraine. Direct exports to the Baltic state have nearly halved from £176m in 2020 to £79m in 2023, with single malts down by two-thirds, falling from £61m in 2020 to £17.9m last year.

For all that, the picture is far from being universally gloomy. In almost all markets single malts and blended malts are outperforming the sector. Even though it has lately been beset by a property crisis, direct exports to China rose by 1% to £235.3m last year (volumes fell by 4.4%, to 2.58m cases in 2023). Imports of blends peaked in 2021, when they reached £63m, but have fallen to £52m. Blends last year made up 22% of exports to China by value (49.2% by volume) and single malts 74.4% by value (42% by volume). Despite the slight faltering in 2023, performance has been strong, with total value exports to China increasing by 254% in the past five years, up from £66.3m in 2020 to £235.3m in 2023.

Singapore, which serves as a re-export hub for China as well as being an affluent market in its own right, saw the value of Scotch imports surge by 19% – up from £313.4m to £377.8m – on volumes which fell from 2.7m cases to 2.56m cases. The fellow former Asian Tiger country of Taiwan has also shown strong and consistent growth, with value exports to the Asian island rising 8% to £340m in 2023. Single malts now make up 61% of the Taiwanee market by value and 32.2% by volume, and these were the stars of the show. There was another strong performance from South Korea, despite a mild slowing in the past 13 months. Value exports to the republic have risen three-fold from £42m in 2020 to £128.3m in 2023. Over the same period, volume imports have more than doubled to 12m cases, and the percentage of single-malt has climbed to 35.3%.

Turkey, too, is showing consistent growth, with value exports rising from £59.6m in 2020 to £130.5m last year. However single malts are performing poorly in the Recep Erdoğan-led nation. Their share of exports by value has fallen from 7.5% in 2020 to 5.1% in 2023, perhaps a sign that Turkey's rampant inflation of 65% is having a reverse premiumisation effect.

UAE was a star performer in the Middle East, with total imports surging from £49.1m in 2020 to £157.9m in 2022 - though they did marginally decline to £130.5m last year. Single malts increased their share from 25.6% to 26%. Meanwhile, value exports of Scotch to Japan dipped from £175m to £170.3m, on volumes which fell from 5.55m to 4.78m cases last year. As with India, a very high percentage of Scotch whisky that is exported to Japan arrives in bulk – 77.2% by volume.

Spain has shown consistent value growth over the past four years, with Scotch exports surging from £109m in 2020 to £184.3m last year. Blends make up 70% of the market, with single malts representing just 17%.

France regained its crown as the world's biggest market for Scotch by volume last year. Overall value exports to the country fell by just 2 per cent – down from £488.4m to £474.3m, while volume exports fell by 15.3 percent from 17m cases to 14.4m. The strongest category is single malts, the value exports of which rose by 5.5% to £246m meaning it now represents 52% of Scotch whisky exports to France, but only 11.9% by volume exports. Bulk exports represent 13.5% of the value of exports to France but 51.3% of volume exports.

So, have we gone from an ‘annus mirabilis' in 2022, when exports broke through the £6.2bn barrier, to an ‘annus horribilis' in which weaker sales are causing the share prices of leading players such as Pernod Ricard and Diageo to fall by 20% and 25% from their 2023 peak valuations? There are worrying signs but it is too much of a Curate's Egg to say.

Ian Fraser is a financial journalist, a former business editor of Sunday Times Scotland, and author of Shredded: Inside RBS The Bank That Broke Britain.