Pernod's Half-Term Report

In the six months to Christmas, Pernod's performance was "robust" claims CEO, Alexandre Ricard despite a 3% drop in organic sales. There was plenty of whiskey talk, just not much on Scotch, reports Tom Bruce-Gardyne …

Pernod Ricard's last set of full-year results, included a stand-out performance from Chivas Regal. In the year to June 2023, net sales of this premium blended Scotch, aged 12 years and above, jumped 25%, while volumes grew 10% to break the 5 million case barrier for the first time. A couple of weeks ago, at Pernod's half-year results (HY24) to last December, there was no mention of Chivas by CEO Alexandre Ricard, nor much comment on Scotch whisky in general.

Whether that's somehow ominous, we do know that Chivas Regal shrunk 15% in volume over the period to 2.7m cases, but because the price mix was up 8%, net sales came in 7% lower overall. Of its blended Scotch stablemates, Ballantine's saw net sales fall 8%, with volumes down 11% to 4.7m cases, while super-premium Royal Salute, bottled at 21 years and above, ramped up its average price and grew 8% in net sales as a result. Although it sells just 200,000 cases a year, Royal Salute was the best performer among Pernod's 'strategic international brands'.

Alexandre Ricard did mention The Glenlivet whose net sales dipped 5% in the six months to December, while volumes were down 14% to 800,000 cases. He announced the world's top-selling single malt enjoyed "very strong growth in India", and "gained market share in the US." Possibly this was at the expense of Diageo North America whose malts tumbled 27% over the same period.

Pernod's CEO likes talking in macro terms, and mentioned four key factors affecting the HY24 results. India, where 95% of the volume and over 80% of the value comes from its Indian whisky portfolio, saw net sales increase by 11%. China, its other 'must-win' market in Asia, fell 9% thanks to "weaker consumer confidence." All eyes are on this year's Chinese New Year (February 10th – 17th) and Ricard expects to have "real sell-out data" by the end of March.

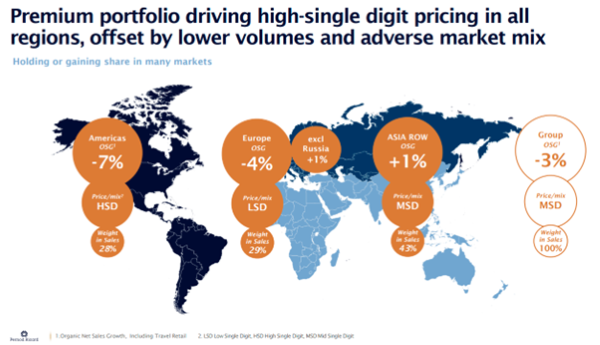

In the US, which accounts for 28% of the company's turnover, net sales fell 7% partly because of "inventory adjustments, particularly at the retail level in a high-interest rate environment," Ricard explained. Despite the fall, he claimed there was: "strong or resilient consumer demand as spirits markets continue to normalise." As previously noted, 'normalisation' may well be the new 'premiumisation' in America.

"We believe the 'sell-out' from the US spirits industry from a value point of view is between 1 – 2%, or 1% if we exclude RTDs (ready-to-drink) as it normalises and eventually catches up with its underlying trend of 4-5%," he continued. Quite why that pre-pandemic trend will necessarily return after the great American trade-up in the time of Covid, is unclear.

Last week, Alexandre Ricard was in the States to launch Pernod's new US $250m Jefferson distillery in Kentucky, and present the company's vision to analysts in New York. He displayed a graph showing trading up in spirits in the US since the Millenium. "When the trend halted in 2009, a number of experts came to the conclusion that premiumisation was dead," he said. "In reality that halt lasted 8 – 10 months, and then our industry experienced its fastest degree of premiumisation in history."

Analysts begged to know how long he thought this current low growth blip, if it is a blip, would last. "6 to 12 months," he replied, adding: "Fundamentally, I do believe the US is a strong growth market" … and that "it's one of the most profitable markets in the world."

To better understand consumer behaviour and make the most effective use of its marketing spend, Pernod has a shiny, new set of digital weapons up its sleeve with names like Maestria, D-Star and Vista Rev-Up. Ricard admitted they weren't quite able to penetrate the American home bar to check whether fancy bottles bought during lockdown had been drunk, and whether they were being replaced like for like, or with something cheaper.

The analysts in New York were told how these tools help "portfolio optimisation", allowing resources to be redirected from one category to another. It makes you wonder which of the company's spirits will benefit. If Conor McQuaid, the newly-appointed CEO of Pernod Ricard North America and a former head of Irish Distillers, decides to double the spend on Jameson's will that starve the likes of Ballantine's and Chivas of marketing dollars?

In September, the company sold its Clan Campbell blend, once the top-selling whisky in France. Its commitment to single malts and Glenlivet in particular, appears to be stronger, and Alexandre Ricard spoke of investing in the category. In 2022, £88m was pledged to boost capacity by 14m lpa at two Speyside distilleries - Aberlour and Miltonduff.

But the latest news concerns India where Pernod Ricard has just announced it is to build one of India's biggest 'malt spirits distilleries' in Nagpur, capable of producing over 20m lpa a year. The country is home to a pair of massive Indian whiskies Imperial Blue on 24m cases and Royal Stag on 27.1m as of 2022. By volume, these are by far Pernod's biggest brands. To what extent their consumers aspire to drink Scotch is unknown. It will be fascinating to see the effect the longed-for cut in import tariffs might have … if it ever happens.

Award-winning drinks columnist and author Tom Bruce-Gardyne began his career in the wine trade, managing exports for a major Sicilian producer. Now freelance for 20 years, Tom has been a weekly columnist for The Herald and his books include The Scotch Whisky Book and most recently Scotch Whisky Treasures.

You can read more comment and analysis on the Scotch whisky industry by clicking on Whisky News.