Diageo's Latin Trade Down

A painful contraction in Mexico and Brazil took Diageo's Scotch business down 10% in its latest results (albeit half that if you exclude Latin America). Yet the company's long-term faith in the category appears as solid as ever reports Tom Bruce-Gardyne.

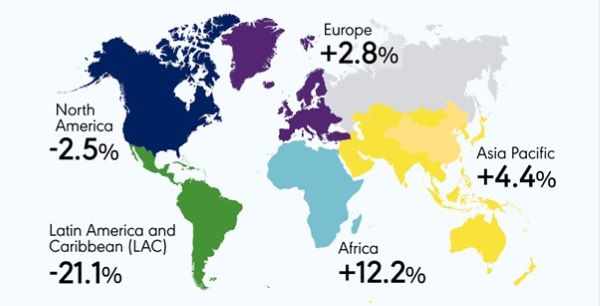

On Tuesday the City gave its verdict on Diageo's results for the year to June 30th (FY24). With net sales down 1.4% - its first global drop in sales since 2020, the drinks giant had failed to meet the market's already low expectations, and the share price tumbled 10% in early trading.

Diageo's CEO, Debra Crew, was quick to identify the culprit. "It was driven, as it was in our interims (HY24), by our performance in Latin America," she explained. The region that includes the Caribbean was 21% down on the previous twelve months. Of the two biggest markets - Brazil fell by 18%, with reportedly 'some stabilisation of consumer demand in the second half', while Mexico collapsed by 30%.

The region accounts for a tenth of Diageo's sales, but a quarter of all its Scotch business. "Latin Americans still love Scotch," Crew insisted. "What we're seeing is some downtrading into more standard-price Scotch brands from more premium ones. But that's fine – we've got Johnnie Walker Red Label. We've got standard Black & White."

There was trading down and trading out of brands like Johnnie Walker whose volumes shrunk 12% in Latin America, while Buchanan's fell by 18% and Black & White by 25%. In Mexico, consumers were 'shifting towards local spirits', it was reported, while 'the operating environment remained highly competitive, particularly in Tequila.'

"In the US, Scotch is being hit because, in terms of price per litre, it's one of the highest within the spirits category," said Crew. "When you get over US$100 a bottle in the US – that's really where it kind of exploded during the pandemic – people weren't going to continue drinking those bottles on a Tuesday night. We think that will come back as the economy improves, but those bottles are definitely feeling the pinch."

This is surely a reference to Johnnie Walker Blue Label which experienced 'continued normalisation of demand', to quote Diageo's results, though 'imploded' might be closer to the truth. Luckily, according to Crew: "Black Label is doing well in the US", where total Johnnie Walker is 10% down, as it is globally.

She also blamed US inflation "particularly around food basket prices, where people say it's a 30 year high. Post the pandemic, you had a lot of households with savings, but it's gone on long enough now that the savings are depleted. So that's really wearying on consumers, some of whom are working pay check to pay check. And even in households that have money, they're just cautious around spending."

With US food inflation there's a whiff of corporate greed. Writing in Forbes in February, Erol Schweizer claimed "the US grocery industry had leveraged pandemic-related supply chain crises to raise prices and reap enormous profits." Some in the US drinks industry, be they distillers or their giant distributors, are no doubt equally guilty.

"Diageo's the category leader, have you considered just lowering prices overall and seeing what happens?" asked the analyst James Edwardes Jones about the States. "We've got super premium brands, and remember super premium plus is what's driving the growth," Crew replied, adding "… lowering price isn't a panacea by any means. And look, we're still very affordable luxury." Your average disenfranchised Johnnie Walker Blue drinker might dispute that.

Leaving aside the grim prospect of a Trump presidency and the return of 10% tariffs on single malts or even all imported spirits, Diageo's Scotch performance in the rest of the world was mixed. In Southern Europe there was 'continued momentum in Johnnie Walker' while in Northern Europe there was double-digit growth in Red Label 'as consumers shifted into the standard price tier.' Overall, the brand's net sales were up 3% in Europe, while its J&B stablemate slipped by 6%.

In Asia Pacific, Scotch declined in Greater China, while sales of Johnnie Walker fell sharply in Vietnam. This was offset by strong growth in 'super-premium-plus' Scotch, notably Johnnie Walker Blue in Korea where the launch of Johnnie Walker Blonde helped recruit new consumers into whisky, it was alleged.

But it was India that produced the most encouraging results for Diageo's Scotch portfolio, with a standout performance from Black & White whose net sales in Asia Pacific leapt by 24% during the period as a result. And this despite the country's punitive import tariffs of 150%. One day, if the longed-for FTA with India ever happens, that tariff might be slashed in half. As the country that consumes half the 'whisky' in the world, if you take that very loose Indian definition of the word, the impact on Scotch would be immense.

This is yet another unknown to ponder for Ewan Andrew, Diageo’s president for global supply and procurement, who was also at the results. Staring into the distance, way beyond the City’s myopic vision, he said of Scotch whisky: “We plan for over years and decades, not months. Our net fill for this year, in terms of how much we put away for the future, was an increase, and we’re planning an increase next year.” And, to this solid vote of confidence in the category, he added: “If you look at Johnnie Walker, it was only a few years ago I sat here and was proud to say we were selling seven bottles a second. With this year’s results, we’re at nine.”

Award-winning drinks columnist and author Tom Bruce-Gardyne began his career in the wine trade, managing exports for a major Sicilian producer. Now freelance for 20 years, Tom has been a weekly columnist for The Herald and his books include The Scotch Whisky Book and most recently Scotch Whisky Treasures.

You can read more comment and analysis on the Scotch whisky industry by clicking on Whisky News.