Whisky performance vs US Stocks

"Turning wholesale whisky into an asset investable for individuals is a very unique idea. Whisky's nature – that its value increases as it ages – is completely different from other commodities..."

- Bloomberg

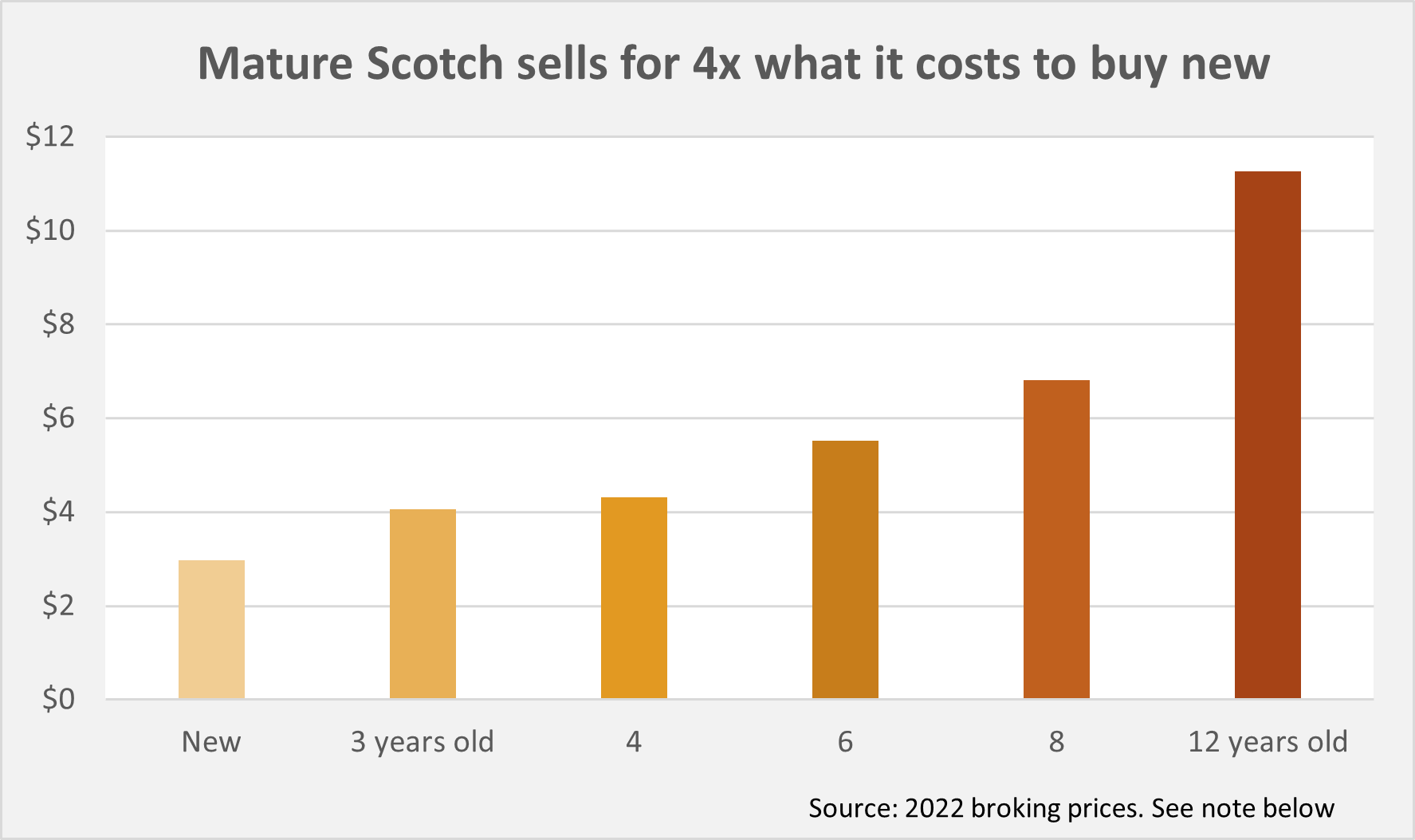

Good Scotch gets better with age. The longer it stays in the barrel, the richer and smoother it becomes and the more money whisky fans will pay to enjoy it.

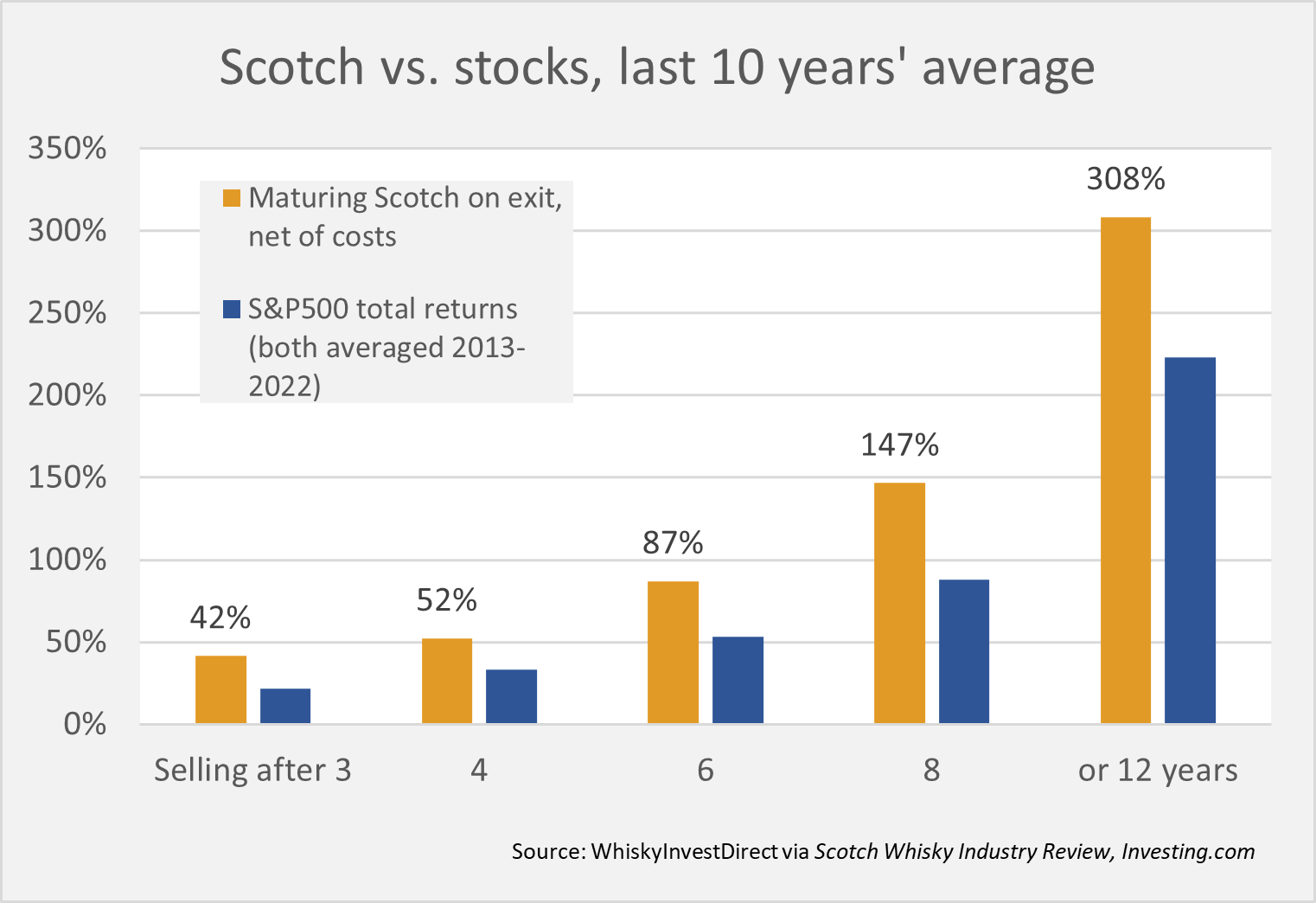

Returns can vary, but the magic of time, oak barrels and damp Scottish air has repeatedly paid strong profits on maturing Scotch whisky. Over the last four decades, wholesale prices show annual gains averaging 11% net of all costs. Across the last 10 years, maturing Scotch beat the stock market hands down, even with dividends included.

Until now Scotland's distilleries kept these gains to themselves, plus a handful of insiders. But today you can access this upside using WhiskyInvestDirect, buying and selling a range of young whiskies all insured and warehoused in Scotland, and all set for demand from big-name brands to make the world's favorite blends.

"A fine way to diversify a portfolio..."

- Florida Weekly

"Spreading capital around is always good sense. Maturing whisky fits my investment principles."

- Customer N.I. in Australia

"Greater liquidity than is normally the case when investing in alternative assets. Ownership of the whisky is very transparent..."

- Herald Scotland

What makes Scotch special? Clever branding and heavy marketing since the 1850s saw Scotch whisky cross the Atlantic to the USA before Coca-Cola reached Europe. Today this $10 billion business is going from strength to strength, with exports in 2022 up by 37% year on year.

Time in the barrel adds flavor and depth for consumers. In fact, Scotch whisky must by law mature for a minimum of 3 years to earn the name. Around 85% of Scotch sold worldwide is blended. Each of those top-selling brands needs to mix together up to 50 different whiskies to create their own unique flavor. You can own a range of these Scotches as they mature using WhiskyInvestDirect.

How does it work? This trade paid 115% in 62 months...

In January 2018 our customers bought maturing Scotch from the Inchgower distillery in Speyside. Made by Diageo, the owner of best-selling blend Johnnie Walker, it's used in many global whisky brands.

Purchased a few weeks after distillation, this batch was ageing in oak hogsheads. It cost $3.69 to buy per liter of pure alcohol, the industry's standard unit.

Another whisky company then came to us in February 2023, asking to buy all that Inchgower from our customers. Those who chose to sell received $9.07 per LPA. Insured storage had meantime cost $0.97 in total (charged monthly). That gave a return of $5.38 net of all costs.

Equal to 19.4% per year, that's well above maturing Scotch whisky's average annual rate of return in US Dollar terms across the last four decades. But this wasn't an unusual occurrence. You can check out our BTB page to see all the recent bids that helped our clients turn a sizable profit.

"Allows private investors to trade for the first time in maturing Scotch whisky..."

- The Scotsman

"The returns I have seen have been better than for most public equity markets. This despite volatility (risk) being significantly lower...more like for investment-grade bonds."

- Customer O.H. in Denmark

The first chart above shows Scotch whisky, average wholesale prices end-2022, converted into US Dollars per Liter of Pure Alcohol (the industry's standard unit). The second chart shows average gains on exit, last 10 years, from selling 50:50 baskets of malt and grain Scotch after the holding periods shown on the horizontal axis. Historic data sourced from Alan Gray's Scotch Whisky Industry Review yearbooks. All calculations are ours. S&P500 historic data from Investing.com

This page provides only general information. It does not consider your personal situation or needs. You are entitled to rely on the truth of the historic data above, but you cannot rely on any forward projections stated or implied. Previous price trends are no guarantee of future movements. Whisky, a physical commodity, is not an investment within the terms and scope of the Financial Services and Markets Act 2000. Your protection is limited to the resale value of the whisky you own, together with normal insurance covering specified risks including fire and theft. You will not be protected by the Financial Services Compensation Scheme, and you may not fully recover your initial investment. Investing in whisky may involve risks which you are currently unaware of. If you are not able to assess this information, seek expert investment advice.